Aspirational Consumer Lifestyle Corp. (NYSE:ASPL) has entered into a definitive combination agreement with private aircraft provider Wheels Up at an enterprise value of $2.1 billion.

Wheels Up provides a marketplace for booking private plane flights with about 1,500 planes on its platform including third-party and managed aircraft.

The combined entity is expected to trade on the NYSE under the ticker symbol “UP” following the transaction’s close expected in the second quarter of 2021.

Transaction Overview

Aspirational brings about $240 million from its current trust into the deal alongside a $550 million PIPE priced at $10 per share. This PIPE drew investment from institutional investors including T. Rowe Price, Fidelity, Franklin Advisors, Durable Capital, HG Vora Capital Management, Third Point, Luxor Capital, and Monashee.

Wheels Up expects to add about $750 to its balance sheet through the deal after about $40 million in expenses.

Existing Wheels Up shareholders are rolling over 100% of their equity and are expected to own about 68.9% of the combined entity. Aspirational shareholders are to hold 8.8% while PIPE investors take 20.1% and the SPAC’s sponsor will hold 2.2%.

Wheels Up shareholders are in line for an additional 9,000,000 shares via an earnout that vests evenly at three price thresholds: $12.50, $15 and $17.50. The parties have not yet filed their merger agreement so any further stipulations on the earnout or other deal terms are not yet public.

Aspirational Chairman and CEO Ravi Thakran is expected the join Wheels Up’s post-transaction Board, and the combined company will continue to be led by its existing management team.

Quick Takes: If ever there was a SPAC true to its name, Aspirational Consumer Lifestyle Corp. combining with a private jet company is one.

But as with the marketplaces discussed in last week’s Top 3, the engine of Wheel’s Up is going to be how well it connects its users to its suppliers.

Wheels Up currently has about 11,000 active users and access to a portfolio of 1,500 private planes. About 1,200 of these are owned by third-party operators, while 170 are either owned or leased by Wheels Up and 160 are from owners who pay Wheels Up a management fee to make them available.

There is still considerable room for growth on the supply side for Wheels Up as the private aviation business remains highly fragmented compared to commercial airlines. The top 10 airlines account for about 90% of US passenger flights, while the top 25 private aviation operators account for just 25% of their respective market.

Wheels Up was the second largest player in this space by flight hours as of August, but that was before it acquired the #10 player, Mountain Aviation, last month. Wheels Up has been a platform for acquisitions since its founding in 2013, and has bought up its fleet on the backs of $536 million in equity funding across six rounds, according to Crunchbase.

That’s a factor to consider when judging the sustainability of its growth, but the fragmented market in front of it may present continued deals cheap and accretive enough to maintain this pace. It also may not need keep up its buying spree as it optimizes its platform. Despite representing a small minority of its overall fleet, its 170 owned and leased planes accounted for 55% of its total flight hours in 2020.

It aims to continue towards a more asset-light approach, increasing the portion of flight hours accounted for by third-party and managed planes to 55% by 2025. Wheels Up estimates about 20,000 private aircraft in the US are idle 97% of the time. That being the case, it shouldn’t be too hard to convince those owners to plug their planes into its platform as a monetization opportunity.

On the other end of its marketplace, Wheels Up has more than doubled its active user base from 4,664 to 10,995, with again the caveat that acquisitions played into this. But, it has monetized them in a way that should provide some stability. About 7.8% of its $690 million in total revenue in 2020E came from $54 million in membership dues as compared to $488 million in revenue from the individual flights themselves.

Wheels Up takes in additional revenue from acting as a broker on aircraft sales and providing software products to partners that amounted to $148 million in 2020E. It expects it can increase this to $521 million annually while growing its total revenue to $2.1 billion in 2025E.

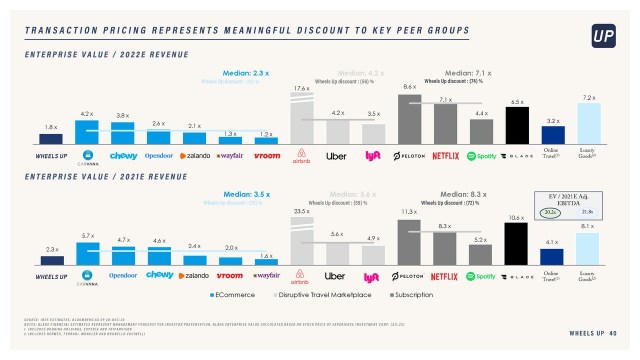

For all that, Wheels Up is still valued fairly cheaply at 2.3x its projected 2021 revenue and 1.8x its revenue in 2022E, which is the year it expects to turn its first $8 million in positive EBITDA. This relatively low price could be the discount of a travel company amid an ongoing pandemic, with most travel companies getting hammered in the market.

But it is still less than a third of the valuation multiples for private helicopter service Blade, which agreed to a combination with Experience Investment Corp. (NASDAQ:EXPC) in December valued at 10.6x 2021E revenue and 6.5x 2022E revenue.

Car marketplace Carvana (NYSE:CVNA) meanwhile trades at 5.7x 2021E revenue and high-end subscription fitness company Peleton (NASDAQ:PTON) trades at 11.3x.

ADVISORS

- Connaught acted as financial advisor to Aspirational.

- Credit Suisse acted as financial advisor, placement agent and capital markets advisor to Aspirational.

- Skadden, Arps, Slate, Meagher & Flom LLP acted as legal advisor to Aspirational.

- Goldman Sachs & Co. LLC, Jefferies LLC, and Morgan Stanley & Co. LLC acted as joint lead financial advisors to Wheels Up.

- Arnold & Porter Kaye Scholer LLP acted as legal advisor to Wheels Up.

Israeli tech firms have made up an outsized proportion of SPAC activity and despite the ongoing tensions in its region, that dealmaking is continuing unabated. In fact, the SPAC named for the particular mission of taking Israeli firms public through SPACs, Israel Acquisition Corp. (NASDAQ:ISRL) in fact just took one step closer in completing that...

At the SPAC of Dawn Although the market has largely recovered from a negative stretch last week, the roller coaster is tilted back downward for Trump Media (NASDAQ:DJT), which slid -8% yesterday to $32.57 – one of its lowest points since closing with Digital World last month. Other SPACs and de-SPACs are having a more...

Remember the metaverse? Many do not. Meta’s (NASDAQ:META) attempted transition to virtually living and working seemed to mark a trend that went up and down quickly, but one SPAC deal has both survived that roller coaster and may rise with a second. Back in December 2022, Newbury Street (NASDAQ:NBST) announced a $1.85 billion combination with...

At the SPAC of Dawn Tucked into the bill that provides $95 billion in funding to American allies passed by the House this weekend is another measure that is likely to have far more impact on at least one pending deal in SPAC world. It would appear that the timing was fortuitous for TikTok rival...

With the passage this weekend of $95 billion in funding for Ukraine, Israel and Taiwan by the House of Representatives, some focus has gone back towards the defense sector, which has generally had a good year as a whole. But, SPACs have not been as active in defense, despite the fact that companies in the...