After Tuesday’s close, Accel Entertainment (ACEL), which was brought public last year through TPG Pace Holdings (TPGH), became the first de-SPAC’d company to call its warrants for shares with a trigger above $10. Very few SPACs are able to get a $10.00 call feature on their warrants, and none had opted to exercise it prior to ACEL. While the transaction does eliminate the “warrant overhang”, it is not going to come cheap. Each full warrant will be exchanged for 0.250 shares of ACEL.

Transaction Mechanics

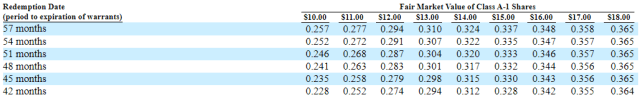

The warrants were priced on the below table using Black-Scholes, which accounts for volatility as well as time value of money. The model uses a relatively high volatility (minimum of 40%) that makes the securities expensive very quickly if the stock begins moving above $10. Since the business combination happened less than eight months ago, it leaves the warrants’ with 52.129 months to expiration, also adding to the firm’s cost to call them.

The fair market value of the common was determined to be $10.095 using a 10-day average closing price ending June 11th. Although it is not shown explicitly in the table, the values meet at 0.250 shares per warrant, as noted in the filing.

Exchange

The full warrant’s value will come out to $2.52 (0.25 multiplied by the $10.095 share value). The warrants closed on Thursday at $2.29, according to FactSet, suggesting the market may have been ready for it. The exchange certainly benefits the investors, though it is hard to believe the company would do this out of their own goodwill.

So this begs the question “why now?”. The exchange can be partially justified using the standard rationale “to clean up the balance sheet” and eliminate the overhang on the stock, but Accel still paid a premium due to the large amount of time value left on the warrant. The company may be expecting good news in the short term and would want to capitalize on the potential upside. Taking that a step further, equity markets are performing well again and management may have wanted to eliminate warrant dilution ahead of a follow-on offering.

Despite a week of general pull-backs in the market, fintech firm Ibotta (NYSE:IBTA) nonetheless took the dive and had a good week debuting via a traditional IPO in the choppy waters. The company, which provides app-based consumer cashback discounts on purchases, priced its IPO at $88, above its proposed range of $76 to $84, and...

At the SPAC of Dawn Happy Friday! SPACInsider has unveiled new presets on SPAC Performance accessible via the Data drop-down to easily sort for the highest and lowest performing active SPACs and de-SPACs. On the de-SPAC side, Vertiv (NYSE:VRT) continues to be well ahead of the pack, logging a 710% return by share price adjusted...

AGBA (NASDAQ:AGBA) stock is up over +90% this morning following a +211% premarket spike on news it has signed a definitive agreement to combine with social streaming video platform Triller. AGBA, the company itself, was formed by the $555 million combination between a SPAC of the same name and TAG Companies, a financial services firm...

At the SPAC of Dawn Since closing its combination with DHC last month, AI customer engagement firm BEN (NASDAQ:BNAI) has rolled out new partnerships with call center and healthcare clients. And, while it faces a fair bit of competition in the chatbot realm, several high-profile institutions have demonstrated that creating one that provides useful services...

Blue Ocean (NASDAQ:BOCN) provided significantly more texture today in the presentation for its $275 million combination with Asian digital media group TNL Mediagene, which it expects to hit profitability in the second half of the year despite a slight shakeup in financing for the transaction. The first big update in the first investor deck is...