If you need further evidence of a hot, hot SPAC market, tonight Churchill Capital Corp. III, which only has a 1/4 warrant included in it’s unit and can remove $1.0 million per year of interest for working capital, STILL managed to upsize their offering by $200 million. As of tonight, Churchill III’s offering is now $800 million, a size we haven’t come close to seeing since Silver Run II priced a $1,035.0 billion SPAC in March of 2017. Since then, the largest sized SPAC has topped out at $690 million (with over-allotments). However, keep in mind that if Churchill III completes their own full over-allotment, they can potentially raise $920 million when all is said and done.

This is a sizzling hot deal and IPO units are going to be scarce, even with an up-size, so chances are good that we see Churchill come out of the gate close to Gores IV’s high of $10.52 as a day-one open price. This also means that former teams, like TPG Pace and Social Capital Hedosophia, and maybe even some new teams, will almost certainly go for a 1/4 warrant as well. Although, Chamath Palihapitiya (former CEO and Chairman of Social Capital Hedosophia), currently has his hands full as Chairman of Virgin Galactic (currently trading around $23.00).

It’s a new world when an $600 million, 1/4 warrant SPAC, can still upsize $200 million as a “blank check” company. But guess what….in a market like this, we can probably expect more changes. Look for envelopes to be pushed now that the 1/4 warrant is “normal”. It’s not stopping here.

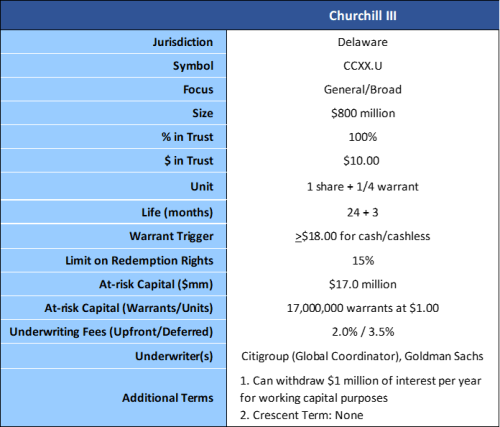

Summary of revised terms below:

Israeli tech firms have made up an outsized proportion of SPAC activity and despite the ongoing tensions in its region, that dealmaking is continuing unabated. In fact, the SPAC named for the particular mission of taking Israeli firms public through SPACs, Israel Acquisition Corp. (NASDAQ:ISRL) in fact just took one step closer in completing that...

At the SPAC of Dawn Although the market has largely recovered from a negative stretch last week, the roller coaster is tilted back downward for Trump Media (NASDAQ:DJT), which slid -8% yesterday to $32.57 – one of its lowest points since closing with Digital World last month. Other SPACs and de-SPACs are having a more...

Remember the metaverse? Many do not. Meta’s (NASDAQ:META) attempted transition to virtually living and working seemed to mark a trend that went up and down quickly, but one SPAC deal has both survived that roller coaster and may rise with a second. Back in December 2022, Newbury Street (NASDAQ:NBST) announced a $1.85 billion combination with...

At the SPAC of Dawn Tucked into the bill that provides $95 billion in funding to American allies passed by the House this weekend is another measure that is likely to have far more impact on at least one pending deal in SPAC world. It would appear that the timing was fortuitous for TikTok rival...

With the passage this weekend of $95 billion in funding for Ukraine, Israel and Taiwan by the House of Representatives, some focus has gone back towards the defense sector, which has generally had a good year as a whole. But, SPACs have not been as active in defense, despite the fact that companies in the...