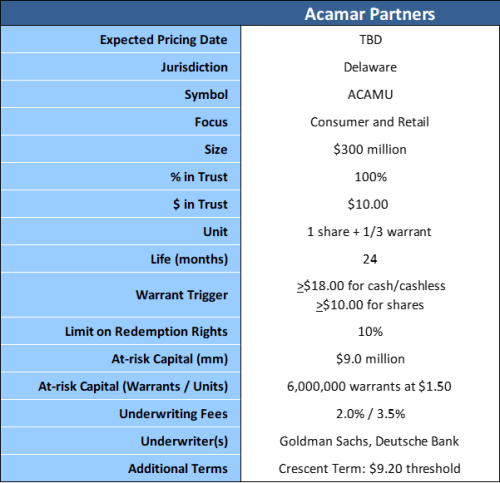

Acamar Partners refiled their S-1 tonight and looks to be getting ready to IPO next week. However, there was one important change to Acamar’s terms – they added the Crescent Term with a threshold of $9.20.

To date, there are now eight SPACs that have either IPO’d with the Crescent term or are on file to IPO with the term.

However, as of late, there is a clear delineation across perceived deal tiers. The tier-1 deals appear to be following Deutsche Bank’s lead by using their threshold of $9.20, first seen in RMG Acquisition Corp., whereas the deals underwritten by the tier-2 banks were previously using $9.50. The lone outlier being Andina III, which used a perplexing $8.50 threshold. The delineation makes sense in a way though. The tier-1 SPACs want to establish a coveted premium price as a way of emphasizing they can command better terms. However, the point of the term is to protect investors from a PIPE done at a price below $10.00. Not to establish position. However, the threshold seems to be being used as a way of signaling status.

The reality is (hopefully), none of these deals will need to use the Crescent Term at all. It’s like buying flood insurance. It just depends on how much you want (or are willing) to be covered. Just something to keep in mind.

Deals using the Crescent term to-date:

- EdtechX – $9.50

- Graf Industrial – $9.50

- Schultze – $9.50

- Andina III – $8.50

- RMG – $9.20

- DiamondPeak – $9.20

- Tortoise – $9.20

- Acamar: $9.20

As for pricing, this new amendment indicates a pricing either late next week or early the week after next. It’s still a little too soon to make that call, but we’ll update as information becomes available. In the meantime, an update summary of terms is below:

Goldman Sachs and Deutsche Bank are bookrunners.

Ellenoff Grossman & Schole LLP and Skadden, Arps, Slate, Meagher & Flom LLP are issuer’s counsel and underwriter’s counsel, respectively.

AGBA (NASDAQ:AGBA) stock is up over +90% this morning following a +211% premarket spike on news it has signed a definitive agreement to combine with social streaming video platform Triller. AGBA, the company itself, was formed by the $555 million combination between a SPAC of the same name and TAG Companies, a financial services firm...

At the SPAC of Dawn Since closing its combination with DHC last month, AI customer engagement firm BEN (NASDAQ:BNAI) has rolled out new partnerships with call center and healthcare clients. And, while it faces a fair bit of competition in the chatbot realm, several high-profile institutions have demonstrated that creating one that provides useful services...

Blue Ocean (NASDAQ:BOCN) provided significantly more texture today in the presentation for its $275 million combination with Asian digital media group TNL Mediagene, which it expects to hit profitability in the second half of the year despite a slight shakeup in financing for the transaction. The first big update in the first investor deck is...

At the SPAC of Dawn A brand new market may have just opened up for space de-SPACs as NASA administrator Bill Nelson announced a shift in the agency’s $11 billion program for a mission to return samples from Mars. Rather than rely on the agency’s internal technologies that would be predicted to get a sample...

Overall deal flow between SPACs and biotech firms has slowed over the last year, but some pending FDA changes could breathe new life into particular business models within the space. In particular, the FDA has asked Congress as part of its 2025 Legislative Proposals to eliminate the interchangeability designation for biosimilar medications, claiming the existing...